What is Ambiguity Aversion? And the difference between risk and uncertainty

Ambiguity aversion, or uncertainty aversion, is the tendency to favor the known over the unknown, including known risks over unknown risks.

Here’s an example

Two boxes.

Box A contains 100 balls: 50 red and 50 black.

Box B also holds 100 balls, but you don’t know how many are red and how many black.

If you reach into one of the boxes without looking and draw out a red ball, you win $100. Which box will you choose: A or B? The majority will opt for A.

Let’s play again, using exactly the same boxes. This time, you win $100 if you draw out a black ball. Which box will you go for now? Most likely you’ll choose A again. But that’s illogical! In the first round, you assumed that B contained fewer red balls (and more black balls), so, rationally, you would have to opt for B this time around.

Don’t worry; you’re not alone in this error – quite the opposite. This result is known as the Ellsberg Paradox – named after Daniel Ellsberg, a former Harvard psychologist. (As a side note, he later leaked the top-secret Pentagon Papers to the press, leading to the downfall of President Nixon.) The Ellsberg Paradox offers empirical proof that we favour known probabilities (box A) over unknown ones (box B).

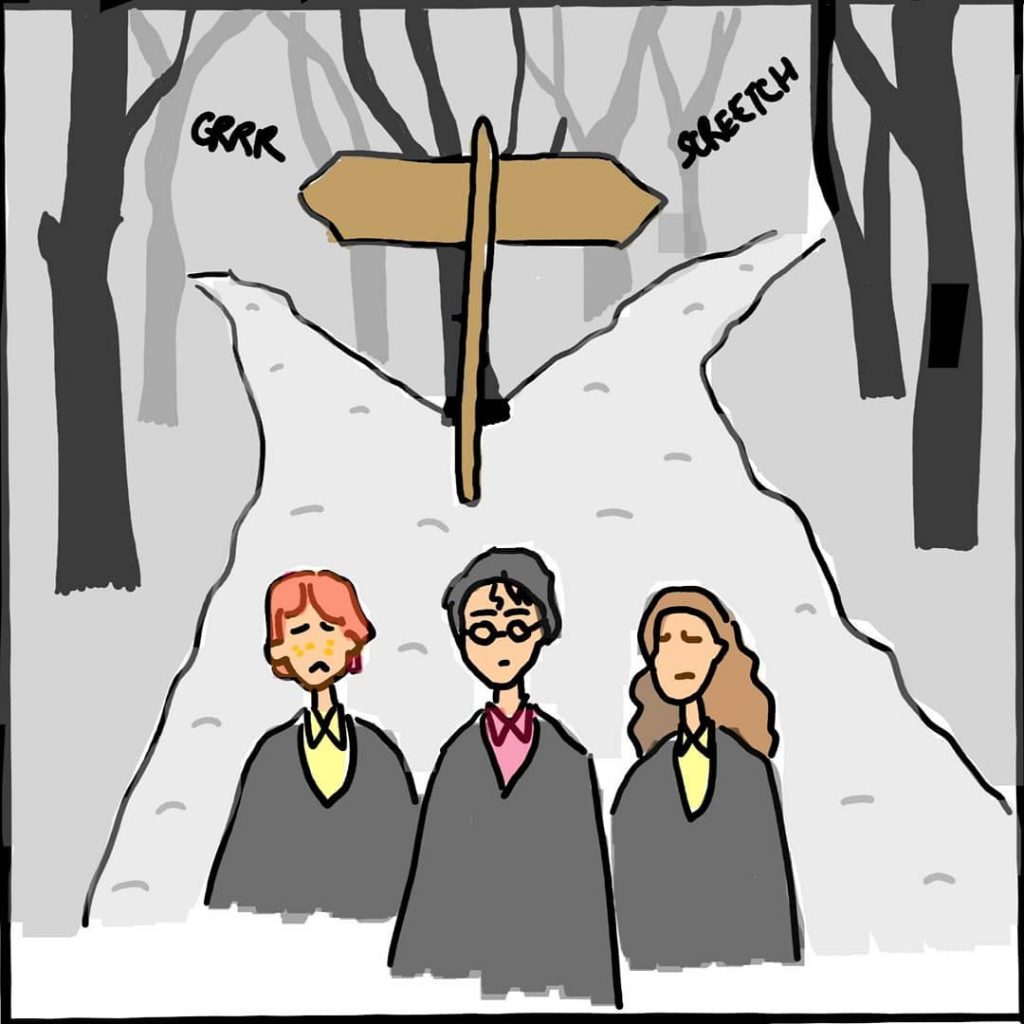

This amazing illustration of the ambiguity aversion was made by @cartoonbias. Do check out their work on Instagram.

Risk and uncertainty (or ambiguity) and the difference between them

Risk means that the probabilities are known.

Uncertainty means that the probabilities are unknown.

On the basis of risk, you can decide whether or not to take a gamble. In the realm of uncertainty, though, it’s much harder to make decisions. The terms risk and uncertainty are as frequently mixed up as cappuccino and latte macchiato – with much graver consequences.

You can make calculations with risk, but not with uncertainty. The 300-year-old science of risk is called statistics. A host of professors deal with it, but not a single textbook exists on the subject of uncertainty. Because of this, we try to squeeze ambiguity into risk categories, but it doesn’t really fit.

Two examples: one from medicine (where it works) and one from the economy (where it does not).

There are billions of humans on earth. Our bodies do not differ dramatically. We all reach a similar height (no one will ever be 100 feet tall) and a similar age (no one will live for 10,000 years – or for only a millisecond). Most of us have two eyes, four heart valves, thirty-two teeth. Another species would consider us to be homogeneous – as similar to each other as we consider mice to be.

For this reason, there are many similar diseases and it makes sense to say, for example:

‘There is a 30% risk you will die of cancer.’

On the other hand, the following assertion is meaningless:

‘There is a 30% chance that the euro will collapse in the next five years.’

Why? The economy resides in the realm of uncertainty. There are not billions of comparable currencies from whose history we can derive probabilities. The difference between risk and uncertainty also illustrates the difference between life insurance and credit default swaps.

A credit default swap is an insurance policy against specific defaults, a particular company’s inability to pay. In the first case (life insurance), we are in the calculable domain of risk; in the second (credit default swap), we are dealing with uncertainty. This confusion contributed to the chaos of the financial crisis in 2008. If you hear phrases such as ‘the risk of hyperinflation is x per cent’ or ‘the risk to our equity position is y’, start worrying.

What can you do about it?

To avoid hasty judgement, you must learn to tolerate ambiguity. This is a difficult task and one that you cannot influence actively. Your amygdala plays a crucial role. This is a nut-sized area in the middle of the brain responsible for processing memory and emotions. Depending on how it is built, you will tolerate uncertainty with greater ease or difficulty. This is evident not least in your political orientation: the more averse you are to uncertainty, the more conservatively you will vote. Your political views have a partial biological underpinning.

In conclusion

Whoever hopes to think clearly must understand the difference between risk and uncertainty. Only in very few areas can we count on clear probabilities: casinos, coin tosses and probability textbooks. Often we are left with troublesome ambiguity. Learn to take it in stride.

Next:

Default Effect – WHY YOU GO WITH THE STATUS QUO

Similar Biases:

The Black Swan – HOW TO PROFIT FROM THE IMPLAUSIBLE

Neglect of Probability – WHY YOU’LL SOON BE PLAYING MEGATRILLIONS

Base-Rate Neglect – WHEN YOU HEAR HOOFBEATS, DON’T EXPECT A ZEBRA

Availability Bias – WHY WE PREFER A WRONG MAP TO NO MAP AT ALL

Alternative Paths – CONGRATULATIONS! YOU’VE WON RUSSIAN ROULETTE

Previous:

In-Group Out-Group Bias – WHY YOU IDENTIFY WITH YOUR FOOTBALL TEAM

The above article is from the book The Art of Thinking Clearly by Rolf Dobelli. The article is only for educational and informative purposes to explain and understand cognitive biases. It is a great book, definitely worth a read!